Assuming ClockCo has no clocks in production yet, the company only has raw materials inventory. However, as the company moves gears into the production line and starts painting, raw materials inventory is reduced, and a new category of inventory called Work in Process arises. The perpetual inventory system provided by modern manufacturing software eliminates big chunks of arduous work from accounting while also reducing or negating data entry errors. In addition, more capable solutions have built-in integrations with financial software such as Xero or Quickbooks, enabling automation of financial data and hugely simplifying purchase and sales order management. Essentially, COGS is to finished goods inventory what COGM is to WIP inventory. Total manufacturing cost, a.k.a total cost of production, is a KPI that expresses the total cost of manufacturing, e.g., all activities directly tied to the production of goods during a financial period.

How confident are you in your long term financial plan?

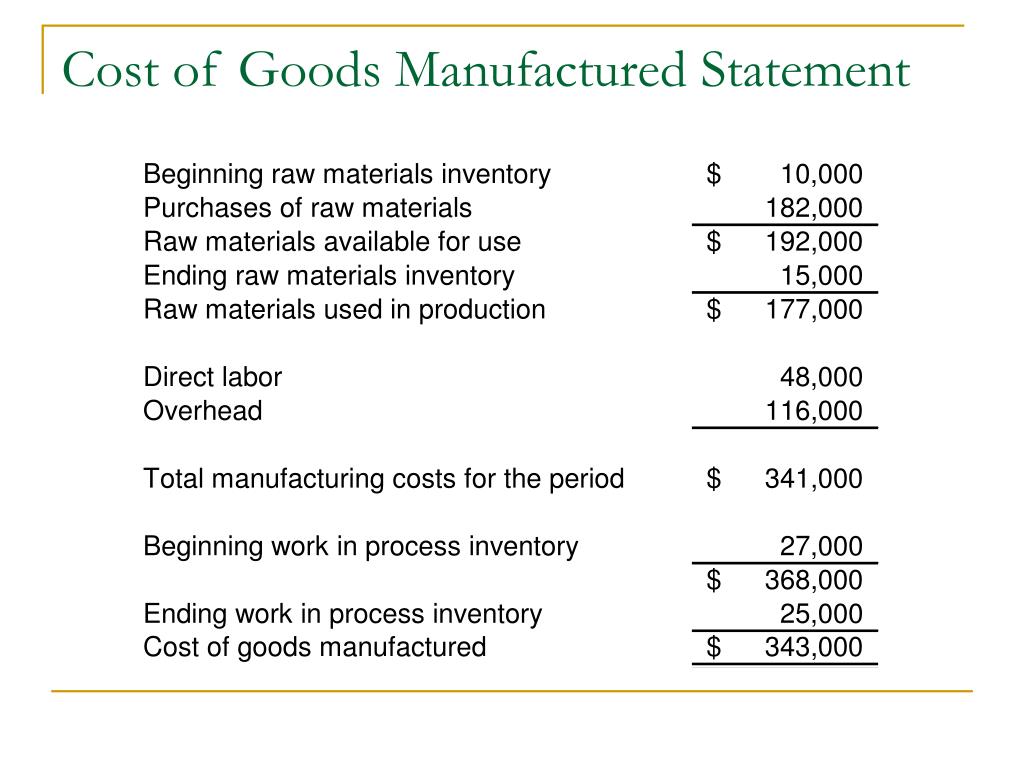

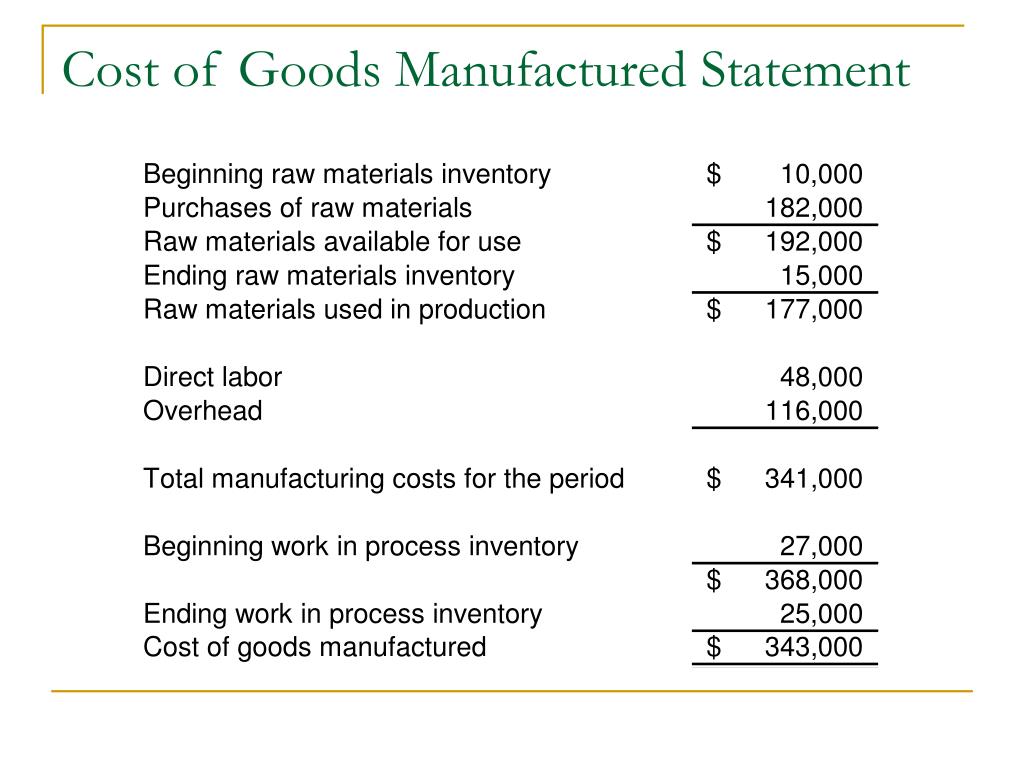

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. A sample cost of goods manufactured schedule appears in the following exhibit. Let us look at an example of the COGM calculation for a furniture manufacturer. The company has $5,000 worth of furniture in the making at the start of the fiscal quarter. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Time Value of Money

Beginning and ending balances must also be considered, similar to Raw materials and WIP Inventory. When calculating COGS, the first step is to determine the beginning cost of inventory and the ending cost of inventory for your reporting period. Due to inflation, the cost to make rings increased before production ended. Using FIFO, the jeweler would list COGS as $100, regardless of the price it cost at the end of the production cycle. Once those 10 rings are sold, the cost resets as another round of production begins.

- Inventory is the difference between your COGS Expense and Purchases accounts.

- Book a free chat with one of our in-house manufacturing experts to determine the solution that’s best for you.

- This means that a company need not wait until the end of accounting periods to find out these crucial financial metrics.

- In this managerial accounting course, you’ll be learning how to calculate those amounts using either job costing or process costing, but for now, let’s assume we know the cost of goods manufactured is $395,000.

See profit at a glance

The debit balance brought down of 105,000 represents the manufacturing cost of goods completed for the accounting period. The adjustment for work in process inventory is necessary as the purpose of the account is to show the manufacturing cost of goods completed during the accounting period regardless of when they started in production. The cost of goods sold then appears in the income statement of the reporting entity, where it is subtracted from sales to determine the gross margin. This calculation can be avoided when a business uses standard costing. If so, the standard cost of each unit sold and scrapped in the period is aggregated to arrive at the cost of goods sold.

The cost of goods manufactured is covered in detail in a cost accounting course. In addition, AccountingCoach PRO includes a form for preparing a schedule of the Cost of Goods Manufactured. Remember that manufacturing overhead is anything that can’t be directly assigned to a specific product. Raw materials consist of both direct materials and indirect materials. The company employs eight shop floor workers – they constitute the direct labor. Finished Goods Inventory, as the name suggests, contains any products, goods, or services that are fully ready to be delivered to customers in final form.

Stay up to date on the latest accounting tips and training

Raw materials inventory can include both direct and indirect materials. Beginning and ending balances must also be used to determine the amount of direct materials used. Ethics and the Manager LO3-4Terri Ronsin had recently been transferred to the Home Security Systems Division of National Home Products. Shortly after taking best accounting software of 2021 over her new position as divisional controller, she was asked to develop the division’s predetermined overhead rate for the upcoming year. The accuracy of the rate is important because it is used throughout the year and any underapplied or overapplied overhead is closed out to Cost of Goods Sold at the end of the year.

Get the 411 on how to record a COGS journal entry in your books (including a few how-to examples!). In the final accounts the manufacturing account is usually presented in a more readable format. Assuming the figures relate to the month ended 31 December an example of a account might appear as follows.

But other service companies—sometimes known as pure service companies—will not record COGS at all. The difference is some service companies do not have any goods to sell, nor do they have inventory. If you’re a manufacturer, you need to have an understanding of your cost of goods sold, and how to calculate it, in order to determine if your business is profitable.

Leave a Reply